Bitcoin (BTC) Kimchi Premium Surges Amid Political Turmoil in South Korea

South Korea is currently facing a tumultuous political landscape, with significant implications for the country’s economy and cryptocurrency market. The South Korean won recently reached its lowest level against the dollar since March 2009, prompting a surge in the Kimchi Premium for bitcoin (BTC).

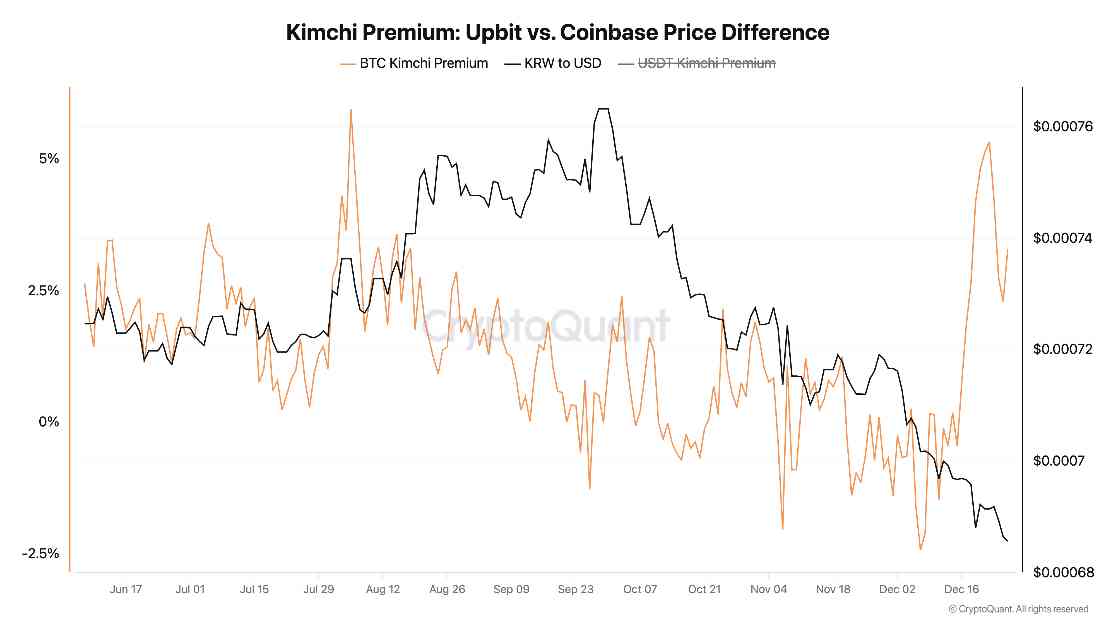

According to data from CryptoQuant, South Koreans are now paying a premium of 3% to purchase bitcoin compared to their U.S. counterparts. This premium reflects a growing desire among South Korean investors to seek refuge in cryptocurrency amidst the ongoing economic instability. On Upbit, the country’s largest crypto exchange, bitcoin is valued at 145,000,000 won ($98,600), significantly higher than the price on Coinbase ($96,700).

The surge in the Kimchi Premium comes in the wake of political turmoil in South Korea, including the recent impeachment of Prime Minister Han Duck-soo and acting President Yoon Suk Yeol. These developments have raised concerns about election fraud and the erosion of trust in the National Election Commission (NEC) in South Korea. Jeff Park, head of alpha strategies at investment manager Bitwise, has highlighted the use of impeachment as a political tool and allegations of foreign election interference as significant threats to democracy not only in Korea but globally.

Expert Perspective: James Van Straten, senior analyst at CoinDesk, emphasized the importance of monitoring Bitcoin’s performance in the current macro environment. With a background in on-chain analytics and experience in understanding Bitcoin’s interactions within the financial system, James provides valuable insights into the implications of political turmoil on cryptocurrency markets.

As South Korea grapples with political uncertainty and economic challenges, the surge in the Kimchi Premium for bitcoin underscores the growing significance of cryptocurrencies as a safe haven asset in times of crisis. This situation serves as a reminder of the interconnectedness of global financial markets and the need for vigilance in monitoring political developments for potential impact on investment strategies.