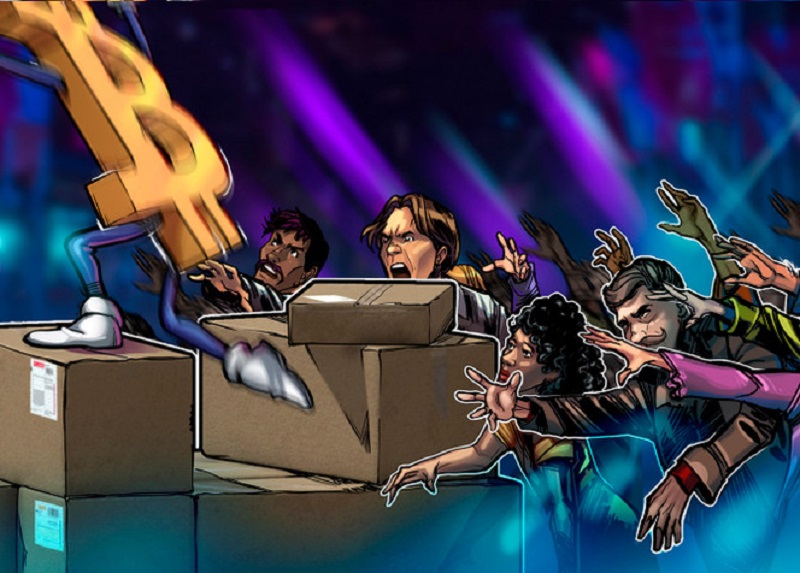

Whether this bull cycle resembles 2017 or perhaps 2019, then nearly all investor”FOMO” and related price profits lie ahead.

Bitcoin bears believing that the $58,000 was that this cycle’s top will probably be sorely disappointed, new investment data in previous bull markets reveals.

When investments of the sum hit a summit, cost action started to reverse, signaling the beginning of a milder retracement.

Based on Whalemap, cash shots in that region have been much from their past peaks annually, suggesting that the present correction will probably be temporary and on level with BTC’s regular adjustments through a bull run.

“Previous macro shirts have happened when tens of thousands of trades worth 5 to 7 million dollars each were flood the blockchain.

The expectation of additional buy-ins supports present information that came to light this week, especially from Coinbase Guru, which has witnessed numerous tranches of over 10,000 BTC render its novels for personal or custody pockets.

The first bad premium on the Grayscale Bitcoin Trust (GBTC) since ancient 2017 can also point to the end that the 2021 bull bicycle still has much more space to operate.

“Another substantial Coinbase outflows in 48k.

“I believe that the significant reason for this fall is that the jittering macro environment such as the 10-year Treasury notice, not whale deposits, miner selling, and absence of institutional demand”

Liquidity catch?

The beginning of the turnaround could be earlier than many believe. In his most recent evaluation, pseudonymous cryptocurrency dealer Rekt Capital eyed the four-hour BTC/USD graph for evidence of a turnaround.

“Pulls back but nevertheless retains the wick-to-wick Higher Low. Strong bullish divergences on the 4HR are emerging too,” the dealer commented along with an annotated screenshot of this graph.

Talking to Cointelegraph, the Whalemap group noted that at the brief term, the spent output ratio ratio (SOPR), that monitors entire market gain and loss, was signaling a deeper sell-off is off the cards, at least for today.

“Hourly SOPR shows possible for at least a brief term bounce,” they stated.

Friday additionally sees a major expiry event on Bitcoin alternatives , something which has ordered temporary downward pressure on BTC previously.

The day’s low of $44,150, some say, was only an effort to suck liquidity before another leg higher.

“Yes, marketplace dropped after’mega-whales’ sold to the rally (as warned), but since then, they’ve been buying drops” Observed the founder of market order book data evaluation service Material Indicators.

“Together with stonks doubt, ” I do not know how a lot more drops there’ll be, but they are being purchased!”

This”doubt” has been exacerbated by about trends in bond returns, Cointelegraph reported that week, together with behaviour seen as much like before the international financial crisis of 2008.