Bitcoin, the world’s leading cryptocurrency, has entered a maturing phase as evidenced by the stability of transaction fees post-halving. This period of fee stability marks a significant shift in the network’s dynamics, reflecting potential improvements in transaction processing efficiency.

The Fluctuating Patterns of Bitcoin Transaction Fees

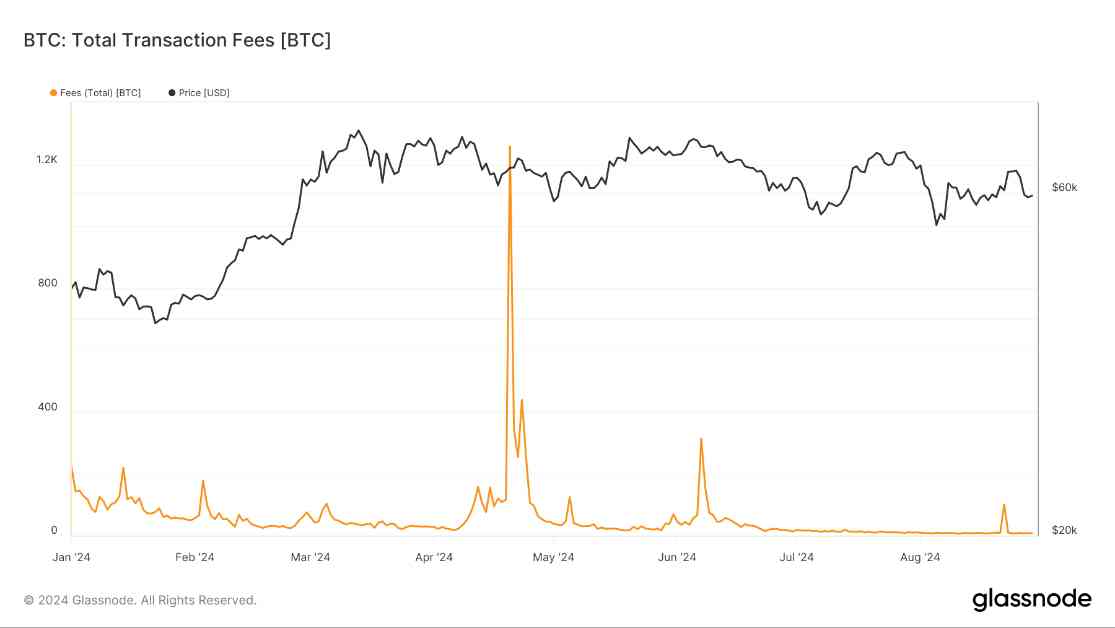

Since the beginning of 2024, Bitcoin transaction fees have exhibited fluctuating patterns, with notable spikes occurring around significant events. The most prominent surge in fees took place in April, coinciding with the highly anticipated Bitcoin halving event. During this period, transaction fees briefly spiked to over 1,200 BTC, highlighting the increased demand for network resources during critical milestones.

This volatility in transaction fees has historically been linked to price movements and network congestion. For example, during the bull markets of 2017 and 2021, transaction fees surged alongside Bitcoin’s price, reflecting the intense activity and congestion on the network. However, the post-halving period in 2024 has seen fees stabilize despite significant price movements, indicating a potential decoupling of fees from Bitcoin’s price.

The Impact of the Halving on Fee Stability

Following the halving event, transaction fees on the Bitcoin network have remained relatively subdued, even as the price of Bitcoin approached $60,000. This stability in fees post-halving is a departure from previous years, where fee spikes often mirrored rapid price increases or network congestion. The current trend suggests a maturing network with potentially more efficient transaction processing capabilities.

The stability of transaction fees post-halving could be attributed to several factors, including improvements in network scalability and the increasing adoption of layer 2 solutions such as the Lightning Network. These developments have helped alleviate congestion on the main Bitcoin blockchain, resulting in more predictable and stable fee structures.

Evolving Market Trends and User Behavior

As 2024 progresses, monitoring the relationship between transaction fees and Bitcoin’s price could offer valuable insights into evolving market trends and user behavior within the ecosystem. The decoupling of fees from price movements indicates a shift towards a more mature and sustainable network, where transaction costs are less dependent on speculative activity.

It will be interesting to observe how this trend evolves in the coming months and whether fee stability persists in the face of changing market conditions. The ability of the Bitcoin network to maintain low fees despite significant price fluctuations will be a key indicator of its resilience and adaptability to market dynamics.

In conclusion, the stability of transaction fees post-halving signals a maturing phase for the Bitcoin network, reflecting potential improvements in transaction processing efficiency and network scalability. As the cryptocurrency ecosystem continues to evolve, monitoring fee dynamics will be crucial in understanding market trends and user behavior within the Bitcoin network.