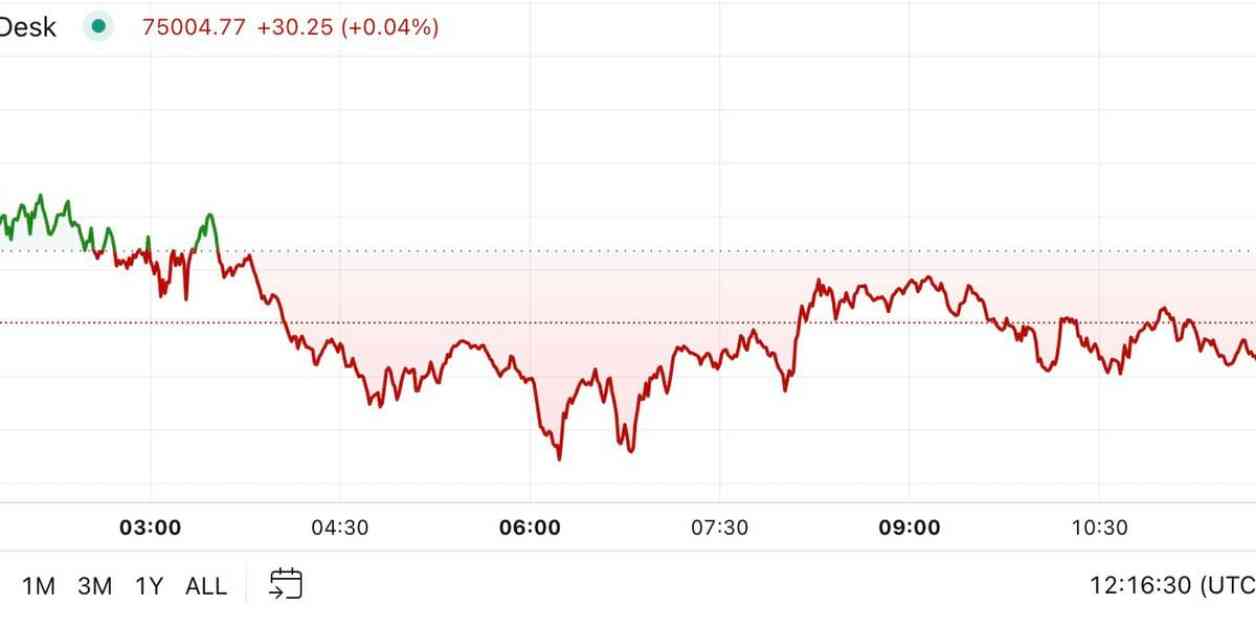

Bitcoin’s price is currently trading at around $75,000, which is slightly lower than its recent all-time high of nearly $76,500. This slight dip comes ahead of the upcoming interest-rate cuts by the Federal Reserve, with analysts predicting a 25 basis-point reduction later in the day. While lower interest rates are typically seen as a positive sign for risk assets like cryptocurrency, this particular cut may not have a significant impact as it is already expected. Traders are already pricing in a near 100% chance of the Fed lowering the benchmark rate to 4.5%-4.7%.

Despite the slight decrease in price, Bitcoin saw a surge in inflows into ETFs, with a net addition of $621.9 million after three consecutive days of outflows. This influx of funds was particularly notable as market leader BlackRock’s IBIT experienced outflows of $69 million. The trading volume in the ETF reached a record high, indicating strong investor interest in the market. Additionally, other ETFs such as Fidelity’s FBTC and ARK 21Shares’ ARKB also saw significant inflows, offsetting the outflows from IBIT.

On the other hand, Ether has seen a significant increase of over 7% in the last 24 hours, outperforming the broader digital asset market. The price of ETH crossed $2,800 for the first time since early August, breaking out of the range it had been trading in for the past few months. Some analysts believe that President-elect Trump’s victory may lead to a resurgence in decentralized finance (DeFi) and a subsequent increase in the price of Ether. The “DeFi Renaissance thesis” is gaining traction, fueled by expectations of deregulation and crypto-friendly policies from the upcoming administration.

Overall, the cryptocurrency market continues to show resilience and strong investor interest, despite fluctuations in prices. While Bitcoin remains steady around the $75,000 mark, Ether’s price surge indicates growing confidence in the digital asset market. As the Federal Reserve prepares for interest-rate cuts, all eyes are on how the cryptocurrency market will react in the coming days. Stay tuned for more updates on the latest developments in the crypto world.