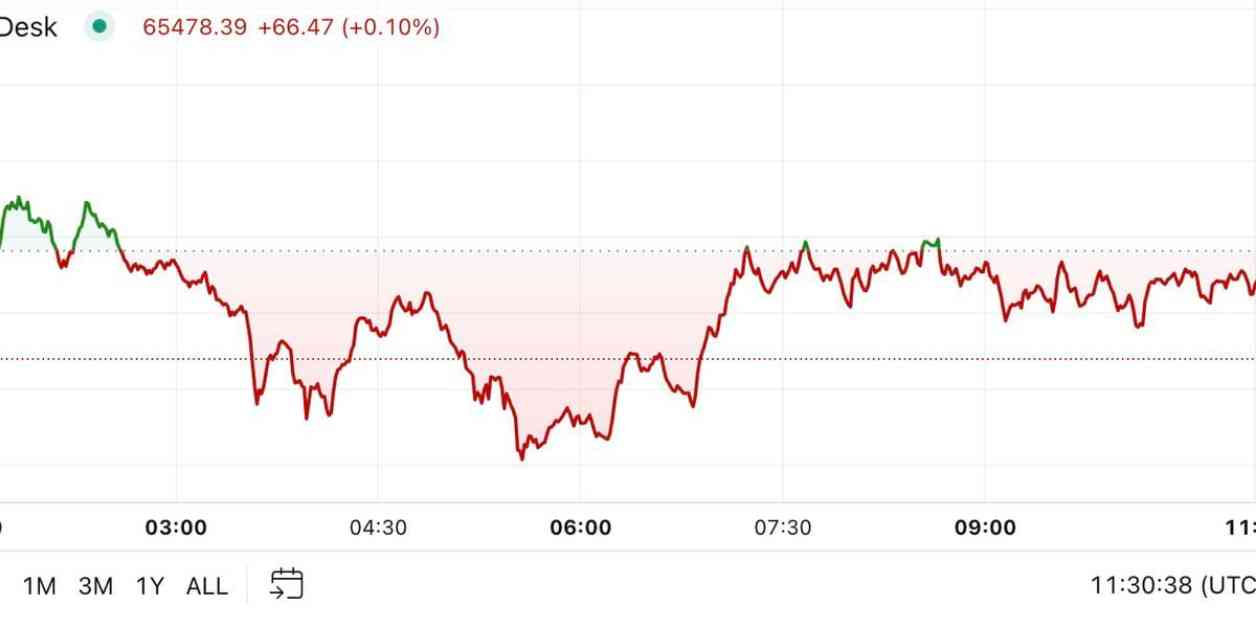

Bitcoin’s price has been relatively stable in the Americas as the leading cryptocurrency takes a breather from its recent bull run. The price of Bitcoin reached over $66,000 for the first time in three weeks on Monday before consolidating between $65,200 and $65,800 during the Asian and European trading sessions. This represents a 0.9% increase over the past 24 hours. The broader digital asset market, as measured by the CoinDesk 20 Index, has also seen a 1.5% increase.

Investors are closely watching Vice President Kamala Harris’ campaign for any hints on the potential crypto regulatory framework under her presidency. However, her latest speech did not mention cryptocurrency, digital assets, or blockchain. Despite this, Bitcoin ETFs recorded a significant inflow of $556 million on Monday, the highest in over four months. Fidelity’s FBTC led the way with gains of $239 million, followed by Bitwise’s BITB with $100 million in inflows. This surge in ETF activity suggests growing investor interest in Bitcoin as it approaches new all-time highs.

In other news, SingularityDAO has announced plans to merge with Cogito Finance and SelfKey to create a new project focused on tokenizing the AI economy. The combined entity, Singularity Finance, will offer a layer-2 network for tokenizing assets like GPUs and will provide AI-powered financial tools. As part of the consolidation, SelfKey’s KEY token will be replaced by Singularity Finance’s new token SFI. Additionally, SingularityDAO’s SDAO and Cogito’s CGV tokens will merge into SFI at specific ratios, subject to stakeholder discussions.

Looking at Google search trends for the term “Bitcoin,” data shows a decline to a yearly low of less than 20. According to Ryan Lee, Chief Analyst at Bitget Research, the last time search interest for Bitcoin dropped to this level was in late January to early February 2024, coinciding with a significant price surge for Bitcoin.

Overall, the cryptocurrency market continues to attract attention from investors and regulators alike. As Bitcoin consolidates its recent gains, all eyes are on potential regulatory developments and market trends that could influence the future price action of digital assets. Stay tuned for more updates on the evolving crypto landscape.