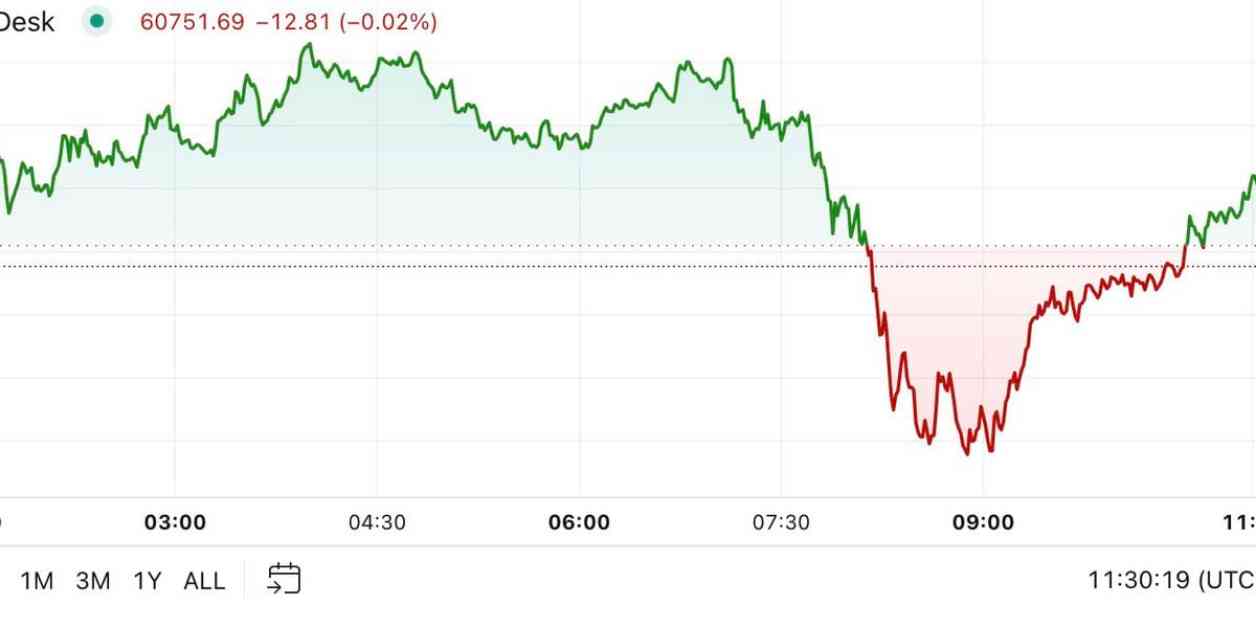

Bitcoin trading remains stable in the Americas despite declines in other major cryptocurrencies around the world. While Bitcoin saw a slight decrease of 0.88% in the last 24 hours, it was relatively flat during the Asian and European trading sessions, hovering around $60,750.

On the other hand, Ether (ETH) experienced a more significant decline of over 3.13%, trading at $2,366.16. The broader digital asset market, as measured by the CoinDesk 20 Index, also saw a 4.2% decrease, with XRP being the worst affected, dropping by 11% due to the SEC’s appeal against the ruling in Ripple’s favor.

Despite the overall negative trend in cryptocurrency prices, there has been an increase in whale accumulation of bitcoin. Whales, referring to entities holding large amounts of assets, are making significant purchases in anticipation of a potential bull run. This accumulation is evident in on-chain data, indicating a bullish sentiment among these influential market players.

In a recent development, Tokyo-listed bitcoin holder Metaplanet Inc. has utilized bitcoin options to increase its BTC holdings. By selling 223 contracts of bitcoin put options at the $62,000 strike with a maturity date of Dec. 27, the company generated a premium of 23.972 BTC (equivalent to $1.44 million). This strategic move resulted in a nominal yield of 10.75% and an annualized yield of 45.63%, providing Metaplanet with additional funds to acquire more bitcoin.

The chart of the day illustrates the BTC balance held by whales in comparison to bitcoin’s price. The data suggests that new whales have been accumulating bitcoin without significant profit-taking, indicating a bullish outlook. According to CryptoQuant founder Ki Young-Ju, these whales are unlikely to sell on exchanges until there is increased liquidity from retail investors.

Overall, while other major cryptocurrencies are experiencing declines, bitcoin trading remains steady in the Americas, supported by whale accumulation and strategic investment decisions by companies like Metaplanet Inc. The market continues to monitor geopolitical events, such as Iran’s air strikes on Israel, which could impact risk assets like bitcoin in the near future.