Bitcoin investors who have held onto their assets for the long term are now taking advantage of the recent rally in Bitcoin prices to secure their profits. This profit-taking activity has been quite significant, with daily realized profits averaging around $5 billion since November 12th. This marks the highest profit levels seen in over a month, according to data from CryptoQuant.

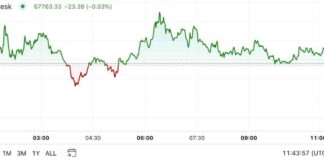

On November 12th, Bitcoin investors pocketed $5.1 billion in profits as the cryptocurrency traded near $88,000. Although profits dipped slightly to $4.75 billion on November 13th, they rose again to $4.8 billion on November 14th, coinciding with Bitcoin’s price hitting a new all-time high above $93,000.

The surge in profits comes on the heels of Bitcoin’s rally above $90,000, which was driven by market optimism following President Donald Trump’s election win on November 5th. Many investors are now choosing to secure their gains after witnessing one of the most impressive runs in Bitcoin’s history.

Data from CryptoQuant’s spent output profit ratio (SOPR) indicates that long-term holders are the ones leading this profit-taking activity. The SOPR metric, which tracks realized profits among different investor groups, experienced a sharp spike on November 13th, reaching its highest level since August. In the past, such trends have often signaled a potential price peak or the beginning of a consolidation phase.

Overall, it seems that Bitcoin investors are capitalizing on the recent price surge to maximize their profits. This behavior among long-term holders could influence the future price movements of Bitcoin, as it may indicate a shift in market sentiment or a period of price stabilization. Investors will be closely monitoring these developments to gauge the next steps in the cryptocurrency market.