MicroStrategy’s recent announcement of their plan to acquire $42 billion more worth of bitcoin has garnered attention, but according to a report by CoinShares, there are risks associated with this ambitious strategy. The company’s ability to execute this plan successfully hinges on a number of factors.

One key factor highlighted in the report is the need for favorable financing conditions and investor demand for MicroStrategy’s convertible debt. The company recently announced a $21 billion stock offering to raise capital for the bitcoin purchase, signaling a significant financial commitment to cryptocurrency. However, the cost of servicing the debt is rising, with coupon rates on new debt issuances increasing compared to zero-coupon convertibles issued in 2021.

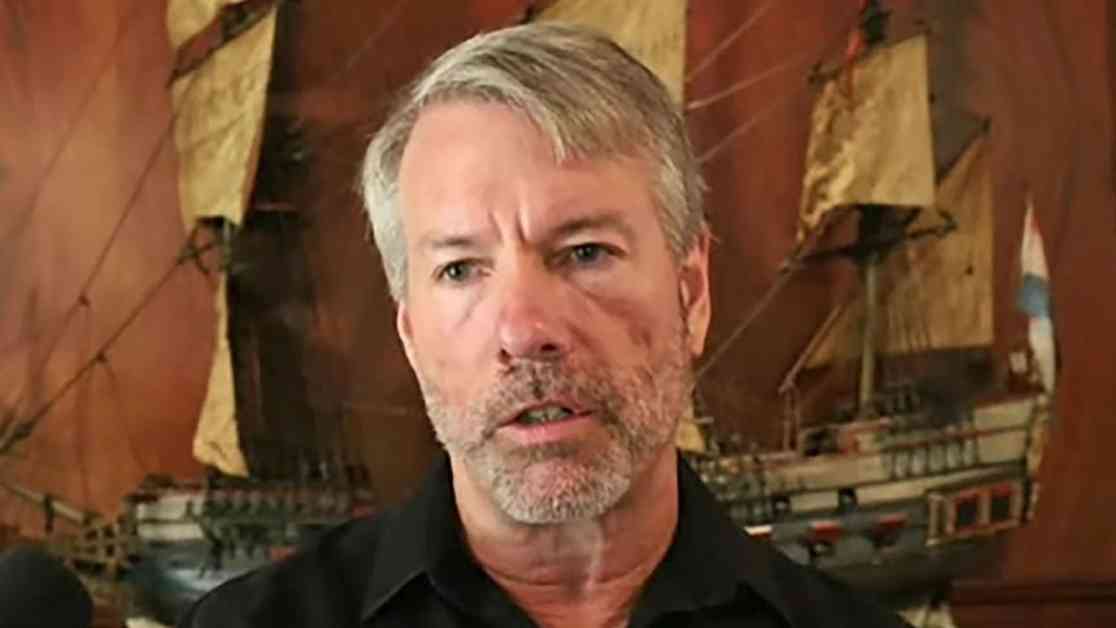

CoinShares also pointed out that MicroStrategy’s valuation is closely tied to its bitcoin holdings. If the company were to sell some of its bitcoin reserves, there is a risk that its valuation premium could diminish. Despite this, CEO Michael Saylor has expressed his reluctance to part with the company’s bitcoin holdings, emphasizing that bitcoin is the exit strategy for MicroStrategy.

In addition to valuation risks, the report highlighted potential tax implications associated with selling off portions of the bitcoin reserves. Any disposals could trigger tax events, leading to significant tax liabilities for the company. Furthermore, as the report suggested, MicroStrategy’s focus on bitcoin may have overshadowed its core software business, raising concerns about whether cash flows from legacy operations will be sufficient to cover future coupon payments.

Despite these risks, investors have shown confidence in MicroStrategy’s stock, viewing it as a way to gain exposure to bitcoin through equity investments. Wall Street broker Canaccord even identified MicroStrategy as one of the best avenues for equity investors to access bitcoin. As a result, the company’s stock price saw an 8% increase in early trading as bitcoin’s price surged towards $70,000.

MicroStrategy’s bold move to acquire a significant amount of bitcoin is not without challenges, but the company’s leadership remains committed to their strategy. As the cryptocurrency market continues to evolve, MicroStrategy will need to navigate these risks while capitalizing on the potential rewards of their bitcoin investments.