The US Securities and Exchange Commission (SEC) has decided to postpone the approval of options trading on Ethereum (ETH) exchange-traded funds (ETFs) on the New York Stock Exchange (NYSE). This delay affects Bitwise’s ETHW, Grayscale’s ETHE and Ethereum Mini Trust, and BlackRock’s ETHA. The SEC mentioned the need for more time to review the proposal and evaluate market implications.

This is not the first time the SEC has extended the decision deadline for ETHW and ETHA, having done so previously on Sept. 26. However, it is the first delay for Grayscale’s funds. Bloomberg ETF analyst James Seyffart had previously predicted that the SEC might make a decision on options for Ethereum ETFs by April 2025.

Interested parties are allowed to submit arguments within 21 days regarding the approval or disapproval of options for Ethereum ETFs, as stated in the filings. Even if the SEC approves the applications, the Options Clearing Corporation (OCC) and the Commodity Futures Trading Commission (CFTC) will also need to give their approval for options trading to proceed.

Options contracts are derivatives that enable two parties to agree on buying or selling an asset at a specific price and within a set time frame. Institutional investors often use options, along with futures contracts, to hedge against their positions in the spot market. Bloomberg senior ETF analyst Eric Balchunas noted that options can attract more liquidity and larger investors to the market, as seen with Bitcoin (BTC) ETFs.

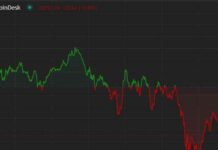

The addition of options trading could potentially bring in more cash flow for Ethereum ETFs. Currently, these ETFs have seen net outflows totaling $410 million, according to data from Farside Investors.