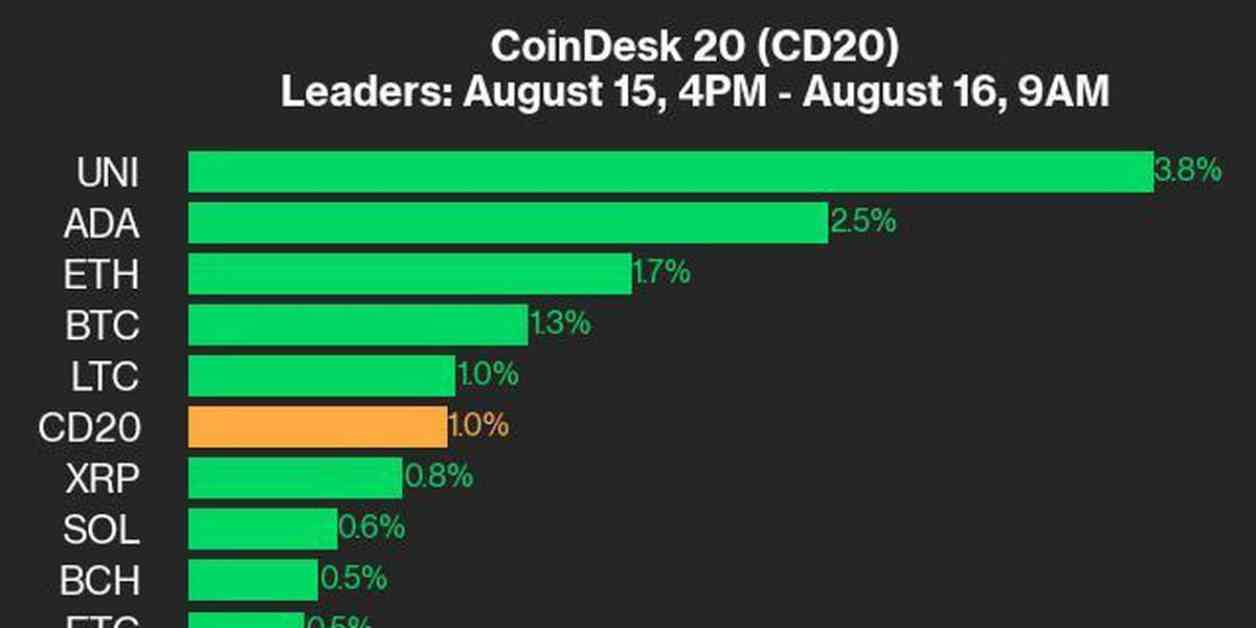

UNI, the native token of the decentralized finance platform Uniswap, has taken the lead on the CoinDesk 20 with a 3.8% gain, marking a significant performance update in the cryptocurrency market. This rise in UNI’s value reflects the overall positive trend in the industry, as digital assets continue to gain traction among investors and enthusiasts worldwide.

UNI’s performance is particularly notable given the current market conditions, with volatility and uncertainty prevailing in the crypto space. Despite these challenges, UNI has managed to outperform other tokens on the CoinDesk 20 index, showcasing its resilience and potential for growth.

Index Rise and Market Dynamics

The CoinDesk 20 index, which tracks the performance of the top 20 cryptocurrencies by market capitalization, has seen a notable increase in value alongside UNI’s gains. This uptrend signals a positive sentiment in the market, with investors showing renewed interest in digital assets as a viable investment option.

The rise in the CoinDesk 20 index can be attributed to various factors, including increased adoption of cryptocurrencies, regulatory developments, and macroeconomic trends. As more institutions and retail investors embrace digital assets, the overall market capitalization of cryptocurrencies continues to expand, driving up the value of the index.

UNI’s Strong Fundamentals

UNI’s performance on the CoinDesk 20 can also be attributed to its strong fundamentals as a token. Uniswap, the platform behind UNI, is a leading decentralized exchange that allows users to trade a wide range of digital assets without the need for intermediaries. This unique value proposition has helped UNI gain popularity among crypto enthusiasts and traders alike.

Additionally, Uniswap’s governance model, which allows UNI holders to participate in decision-making processes on the platform, has further enhanced the token’s utility and value. By giving users a voice in the direction of the project, UNI has fostered a strong community that is committed to the long-term success of the platform.

Acquisition by the Bullish Group

In November 2023, CoinDesk was acquired by the Bullish group, a prominent player in the cryptocurrency industry. The Bullish group, which also owns Bullish, a regulated digital assets exchange, is majority-owned by Block.one, a blockchain company with significant holdings of digital assets, including bitcoin.

The acquisition of CoinDesk by the Bullish group marks a significant milestone for both companies, as it brings together two leading players in the crypto space. By joining forces, CoinDesk and the Bullish group aim to leverage their respective strengths and expertise to drive innovation and growth in the industry.

Editorial Independence and Integrity

Despite the acquisition, CoinDesk continues to operate as an independent subsidiary with an editorial committee in place to protect journalistic independence. This commitment to integrity and editorial freedom ensures that CoinDesk’s journalists can report on the cryptocurrency industry with transparency and objectivity.

It is worth noting that CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation. This arrangement aligns the interests of CoinDesk’s team with the success of the Bullish group, fostering a collaborative and mutually beneficial relationship between the two entities.

Future Outlook for UNI and the CoinDesk 20

As UNI continues to lead the CoinDesk 20 with its impressive gains, investors and analysts are optimistic about the token’s future prospects. With its strong fundamentals and growing community support, UNI is well-positioned to sustain its upward momentum and potentially achieve new milestones in the coming months.

Similarly, the CoinDesk 20 index is expected to remain a key benchmark for tracking the performance of the top cryptocurrencies in the market. As digital assets continue to gain mainstream acceptance and adoption, the index is likely to reflect the evolving dynamics of the cryptocurrency industry, providing valuable insights for investors and stakeholders alike.

In conclusion, UNI’s performance on the CoinDesk 20 and the rise of the index itself underscore the growing significance of digital assets in the global financial landscape. With continued innovation and adoption, cryptocurrencies are poised to play a transformative role in shaping the future of finance, offering new opportunities and possibilities for investors and users worldwide.