Russia Embraces Crypto to Circumvent Western Sanctions in Oil Trade

In a bid to sidestep Western sanctions and bolster its oil trade with China and India, Russia has increasingly turned to cryptocurrencies as a viable alternative. This strategic move, valued at $192 billion, has raised eyebrows globally, as reported by Reuters on March 14, 2025, at 1:57 p.m. UTC. While traditional fiat currencies have long been the norm in international transactions, the utilization of crypto presents a more convenient and flexible avenue for conducting business.

Diving deeper into the realm of cryptocurrencies, Russia has begun exploring the potential benefits they offer in navigating economic restrictions. Recently, the Bank of Russia put forth proposals to establish an experimental legal regime (ELR) lasting three years. This initiative aims to permit a select group of Russian investors to engage in cryptocurrency trading, marking a significant shift in the country’s financial landscape.

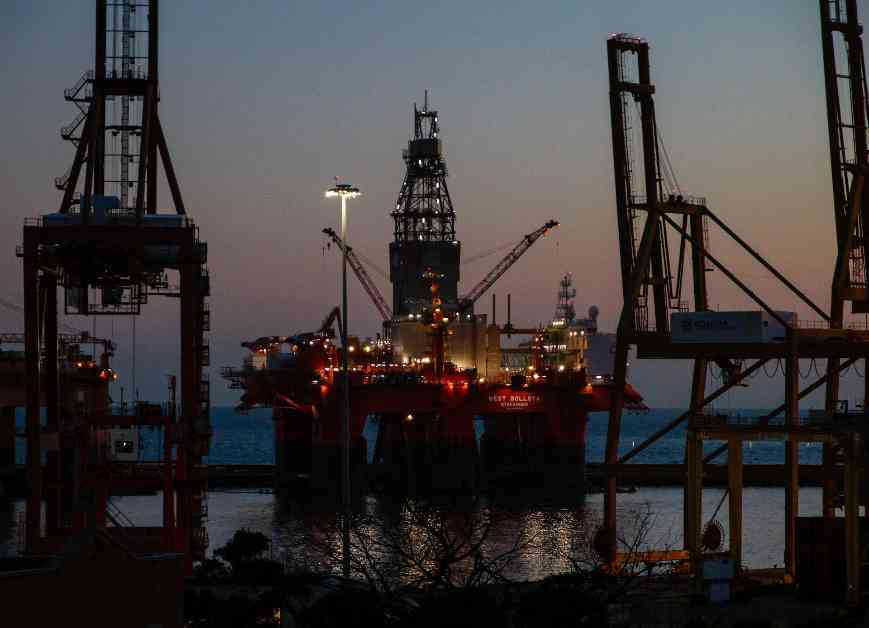

Russia’s Crypto Adoption in Oil Trade

According to sources familiar with the matter, some Russian oil companies have embraced digital currencies like bitcoin, ether, and stablecoins such as Tether (USDT) to convert payments denominated in Chinese yuan and Indian rupees into roubles. Although these crypto-facilitated transactions currently represent a small fraction of Russia’s overall oil trade, they serve as a crucial workaround to circumvent Western sanctions effectively.

This innovative approach mirrors similar strategies employed by other sanctioned nations like Iran and Venezuela, who have leveraged cryptocurrencies to sustain their trade activities while reducing their reliance on the U.S. dollar—the predominant currency in global oil markets. By diversifying their payment systems and incorporating crypto into the mix, Russia has demonstrated a proactive stance in mitigating the impact of sanctions on its oil transactions.

The Future of Crypto in Russia’s Financial Landscape

Despite the potential lifting of sanctions in the future, Russia is likely to continue leveraging cryptocurrencies in its oil trades due to their perceived convenience and flexibility. Moreover, the country is actively exploring the integration of a digital ruble into its financial ecosystem, aiming to enlist the support of major banks for retail and commercial use. This strategic move aligns with the Bank of Russia’s vision of deploying a ruble-backed central bank digital currency as a strategic tool against sanctions, a concept first proposed in 2021.

In conclusion, Russia’s foray into cryptocurrencies as a means to navigate economic sanctions underscores the evolving landscape of global trade and finance. By embracing innovative solutions and diversifying its financial toolkit, Russia is poised to adapt to the ever-changing dynamics of the international market while retaining its competitive edge in the oil trade sector.

Francisco Rodrigues, a seasoned reporter with a keen interest in cryptocurrencies and personal finance, sheds light on the transformative role of crypto in reshaping Russia’s economic landscape. With a diverse portfolio that includes bitcoin, ether, solana, and PAXG, Rodrigues brings a unique perspective to the evolving narrative of digital assets in the global economy.