Bitcoin ETFs have seen a significant increase in investment, with total inflows reaching $6.165 billion as of November 21st. This surge in investment includes a record-breaking $1.005 billion inflow on November 21st alone. The leading ETF, IBIT, attracted $4.683 billion, while FBTC followed with $1.050 billion in inflows.

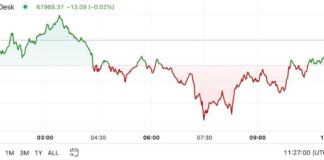

This surge in investment coincides with Bitcoin’s price rally, with the cryptocurrency reaching $98,200 on November 21st and surging even higher to around $99,500 on November 22nd. The increased interest in Bitcoin ETFs comes after the U.S. presidential election, where Trump secured victory in November 2024.

Following the election, Bitcoin’s price soared over 30% to hit $93,400 on November 13th, setting new all-time highs in the days that followed. This rally in Bitcoin’s price has likely contributed to the growing institutional interest in digital assets, as reflected in the substantial inflows into Bitcoin ETFs.

Investors are increasingly turning to Bitcoin and other digital assets as a hedge against economic uncertainty and inflation. The growing interest in Bitcoin ETFs suggests that institutional investors are recognizing the potential of cryptocurrencies as a valuable investment opportunity.

The data provided shows the inflows into various Bitcoin ETFs, with IBIT and FBTC leading the pack in terms of total investment. The consistent inflows into these ETFs indicate a sustained interest in Bitcoin and digital assets among investors.

Overall, the record-breaking inflows into Bitcoin ETFs in November highlight the growing popularity of cryptocurrencies as an investment option. As institutional interest in digital assets continues to rise, Bitcoin and other cryptocurrencies are likely to play an increasingly significant role in the financial markets.