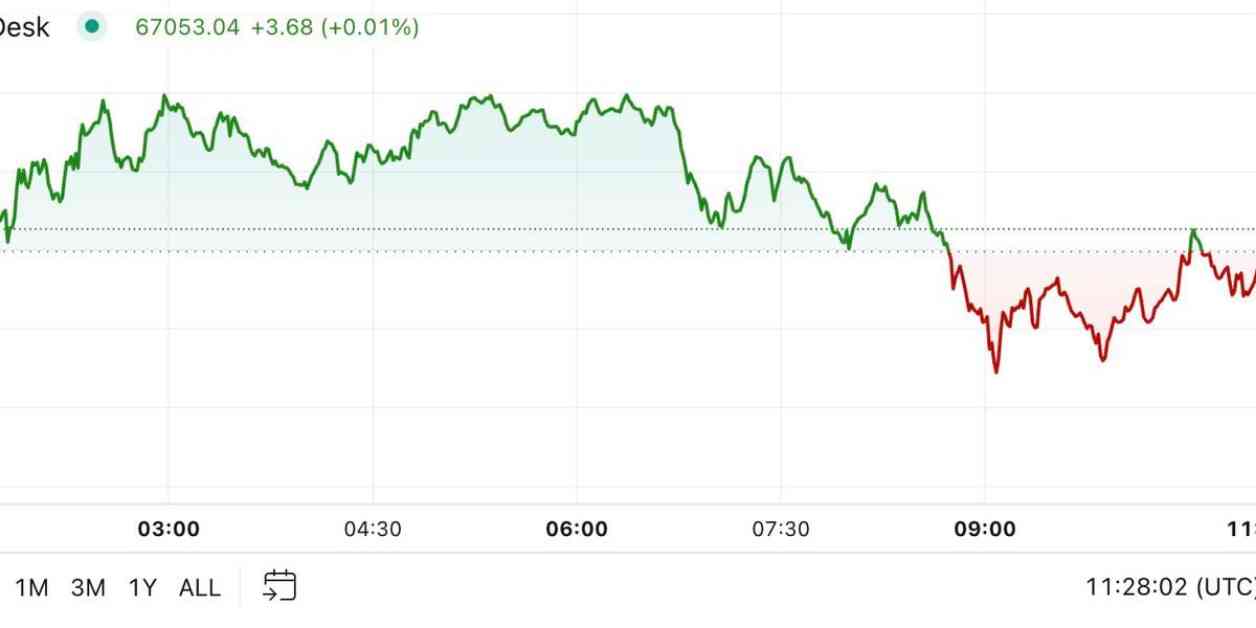

Bitcoin’s price has surged back to $67,000 after the release of U.S. economic data that hinted at a possible quarter-point rate cut in November. The Federal Reserve’s Beige Book survey revealed a somewhat bleak economic outlook, with nine out of 12 regional banks reporting stagnant or weak economic activity since early September. BTC has been trading around $67,000 during the European morning, marking a 0.75% increase in the last 24 hours. The broader digital asset market, as indicated by the CoinDesk 20 Index, has also seen a 0.4% rise.

The number of large bitcoin holders, known as whales, who own at least 1,000 BTC has increased to 1,678, the highest level since January 2021. This surge in accumulation by major holders, coupled with strong interest in alternative investment vehicles like U.S.-listed spot ETFs, reflects a growing confidence in the future price of bitcoin. On the other hand, retail investor accumulation has slowed down as the price of the cryptocurrency approaches $70,000.

SOL, a popular cryptocurrency, has experienced significant gains in the last 24 hours, with a 4% jump to $173. Its weekly increase stands at 14%, reaching price levels last seen in early August. SOL has set a new record high against ether, while memecoins like POPCAT, BONK, and GOAT have seen up to a 70% rise in response to increased network volumes and trading activity. The Solana ecosystem continues to be a vibrant trading hub with a strong community and a focus on small-cap trading.

In the past 24 hours, over 40,000 new tokens were created on Solana, indicating a high level of activity within the ecosystem. The chart of the day shows that both Deribit’s bitcoin implied volatility index (DVOL) and CBOE’s gold ETF volatility index remain subdued, suggesting that traders are not anticipating extreme movements leading up to the U.S. election.

Overall, the cryptocurrency market is showing signs of resilience and continued interest from both large holders and retail investors. The fluctuations in prices and the growing number of tokens being created highlight the dynamic nature of the digital asset space. As the market reacts to economic data and global events, investors and traders are closely monitoring developments to make informed decisions about their holdings.