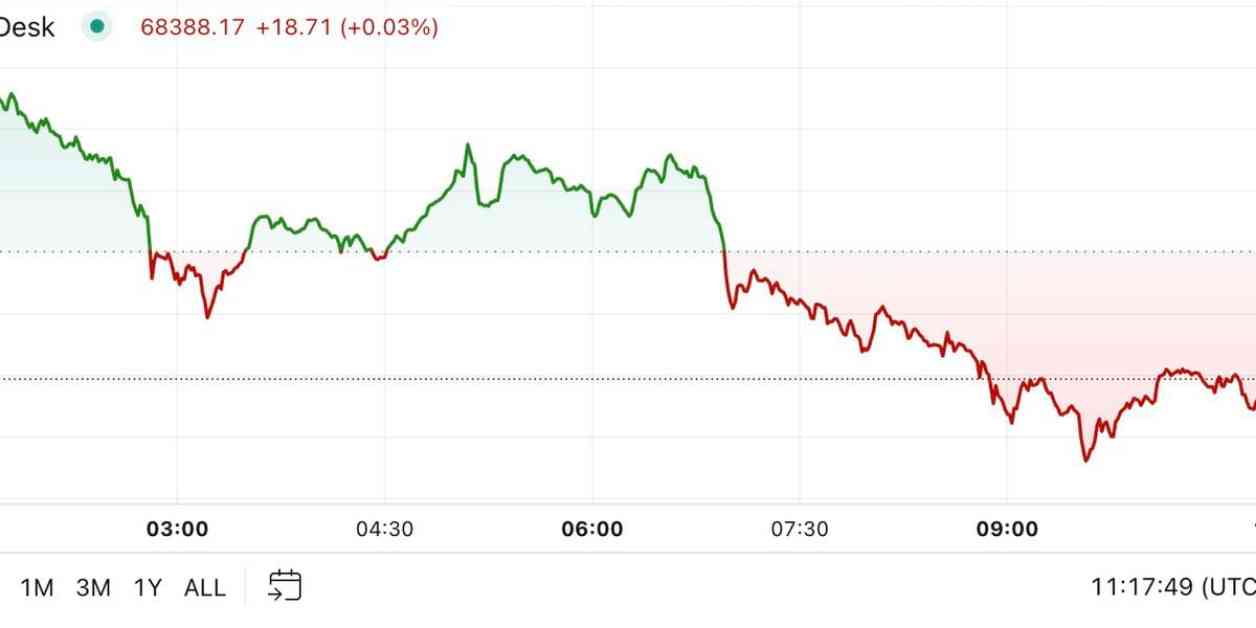

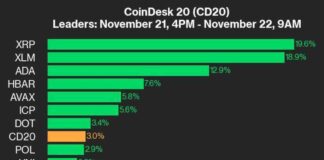

Bitcoin’s price surged above $69,000 in the Americas, marking a significant milestone for bulls in the crypto market. The initial spike in BTC’s price led to a ripple effect across other digital assets, with SOL experiencing a nearly 5% increase to $166.50. The overall digital asset market, as indicated by the CoinDesk 20 Index, rose by 1.9% over the last 24 hours.

Investors are closely monitoring the upcoming U.S. election, with the pro-crypto candidate Donald Trump being favored on prediction sites like Polymarket. Additionally, macroeconomic factors in Japan and China are expected to support risk assets such as bitcoin, according to experts at Singapore-based QCP Capital.

ApeCoin (APE), a cryptocurrency affiliated with the Bored Ape Yacht Club, saw its value double over the weekend, reaching over $1.5 for the first time since April. The surge in ApeCoin’s value coincided with the launch of the ApeChain blockchain network and the introduction of native staking yield options for APE, ETH, and stablecoins. This move attracted significant investor interest in ApeCoin, according to industry experts.

Legal & General, a prominent pensions giant based in London, is exploring tokenization as a means to enhance efficiency and broaden investment opportunities for a wider range of investors. This trend towards tokenization has gained momentum in the traditional finance sector, with firms like BlackRock, Franklin Templeton, State Street, and Abrdn venturing into the space. Legal & General’s global head of trading, Ed Wicks, highlighted the importance of digitizing the funds industry to drive innovation and reduce costs.

In the midst of these developments, gold has reached a new all-time high of $2,736 per ounce, signaling a shift towards risk-on assets like BTC in a lower-yield environment. Mena Theodorou, co-founder of crypto exchange Coinstash, pointed out that the move into gold could pave the way for increased interest in Bitcoin as investors seek higher returns.

Overall, the crypto market continues to witness significant price movements and adoption by traditional financial institutions, indicating a growing acceptance and integration of digital assets into the global financial landscape. As the industry evolves, investors and stakeholders are likely to see more opportunities for growth and innovation in the digital asset space.