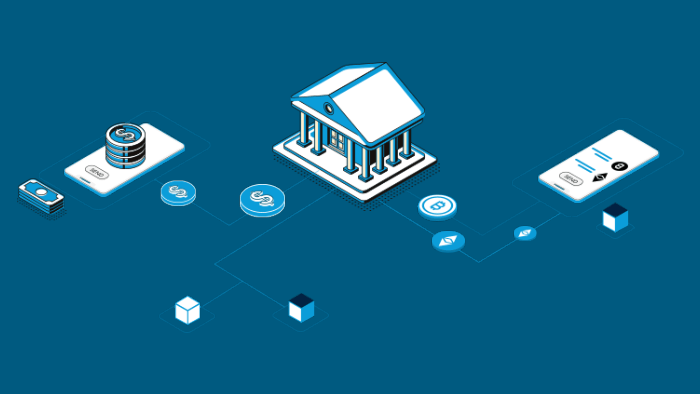

The world of banking has undergone significant changes over the years, with digitalization being at the forefront of these changes. With the advent of cryptocurrencies, particularly Bitcoin, there is no doubt that the future of banking will be shaped by this revolutionary technology.

Bitcoin, which was created in 2009, is a decentralized digital currency that operates independently of central banks. The currency is based on a peer-to-peer network that allows for the secure transfer of funds without the need for intermediaries.

One of the main advantages of Bitcoin is its security. Transactions made using Bitcoin are encrypted and can be traced, making it virtually impossible for fraudsters to tamper with the system. Additionally, Bitcoin transactions can be completed quickly and with minimal fees, making it an attractive alternative to traditional banking methods.

The use of Bitcoin has also gained popularity among merchants and businesses. As the currency gains wider acceptance, more businesses are beginning to accept it as a form of payment. This is particularly true for online businesses, where Bitcoin is increasingly being used as a way to pay for goods and services.

The significance of Bitcoin in the future of banking cannot be overstated. With the increasing popularity of digital currencies, it is becoming clear that traditional banking methods are becoming outdated. Bitcoin’s decentralized nature allows for greater transparency and security, making it a viable alternative to traditional banking methods.

Furthermore, Bitcoin has the potential to revolutionize the way we think about money. By decentralizing the currency, it has the potential to reduce the power of central banks and governments, giving more power to the people.

In fact, some experts believe that Bitcoin could be the key to unlocking financial freedom for the unbanked. According to a report by the World Bank, an estimated 1.7 billion people around the world do not have access to traditional banking services. Bitcoin’s decentralized nature could provide these people with access to financial services, regardless of their location or socioeconomic status.

Despite the potential benefits of Bitcoin, there are still some challenges that need to be addressed. One of the biggest challenges is the lack of regulatory oversight. Many governments are still grappling with how to regulate cryptocurrencies, which could limit their widespread adoption.

Additionally, the high volatility of Bitcoin has made some investors cautious about investing in the currency. While Bitcoin has seen significant gains in recent years, it has also experienced significant price fluctuations, which could make some investors hesitant.

In conclusion, the importance of Bitcoin in the future of banking cannot be understated. With its decentralized nature, high security, and low transaction fees, Bitcoin has the potential to revolutionize the way we think about money. While there are still some challenges that need to be addressed, it is clear that cryptocurrencies are here to stay and will play an important role in shaping the future of banking.