BTC spot price action appears gloomy Monday, but traders, analysts, and others note that there is practically no reason to be bearish about Bitcoin.

Bitcoin (BTC) starts a new week in a precarious place — below $45,000 and below some key moving averages. What’s next?

Bitcoin erased the majority of its recovery almost a week after a series of unwinding leveraged positions brought the market down to $42,800.

There was little to no paradigm shift over the weekend, but now there is downside volatility. Cointelegraph looks at five factors that could help traders predict the next move, as BTC/USD fell 13% in one week.

Stocks due for rebound

After the selling pressure that was added to Bitcoin’s problems in the first half September, stocks are expected to perform better.

Expectations are that equity markets will rally now that they have had a bad week. This is continuing the trend which has characterized markets since March 2020’s Coronavirus crash.

“Expecting equities to bounce this week and provide some relief for Bitcoin,” Charles Edwards, CEO of investment manager Capriole, forecast.

Over the past year, Bitcoin’s relationship to macro trends has been more and more in doubt. However, BTC price action is still affected by shocks to the system, as demonstrated by the Federal Reserve Jackson Hole virtual Summit earlier in September.

“The world still sees Bitcoin as a risk on asset,” Edwards added in comments alongside a comparative chart.

“Almost all Bitcoin corrections in 2021 have been correlated with a S&P500 error of -2% or greater.”

Contrarily, strong stocks could help to maintain the strength of U.S. dollars, which may also give Bitcoin more breathing room.

The U.S. currency index (DXY), saw a rapid move towards 93 last Wednesday before it stopped to consolidate its gains. This process continues.

Spot price falls further below bullish metrics

Forecasts suggest that macro moves could prove decisive in determining the trajectory of Bitcoin’s price this week.

After the weekend’s volatility, BTC/USD fell below $45,000 on Sunday.

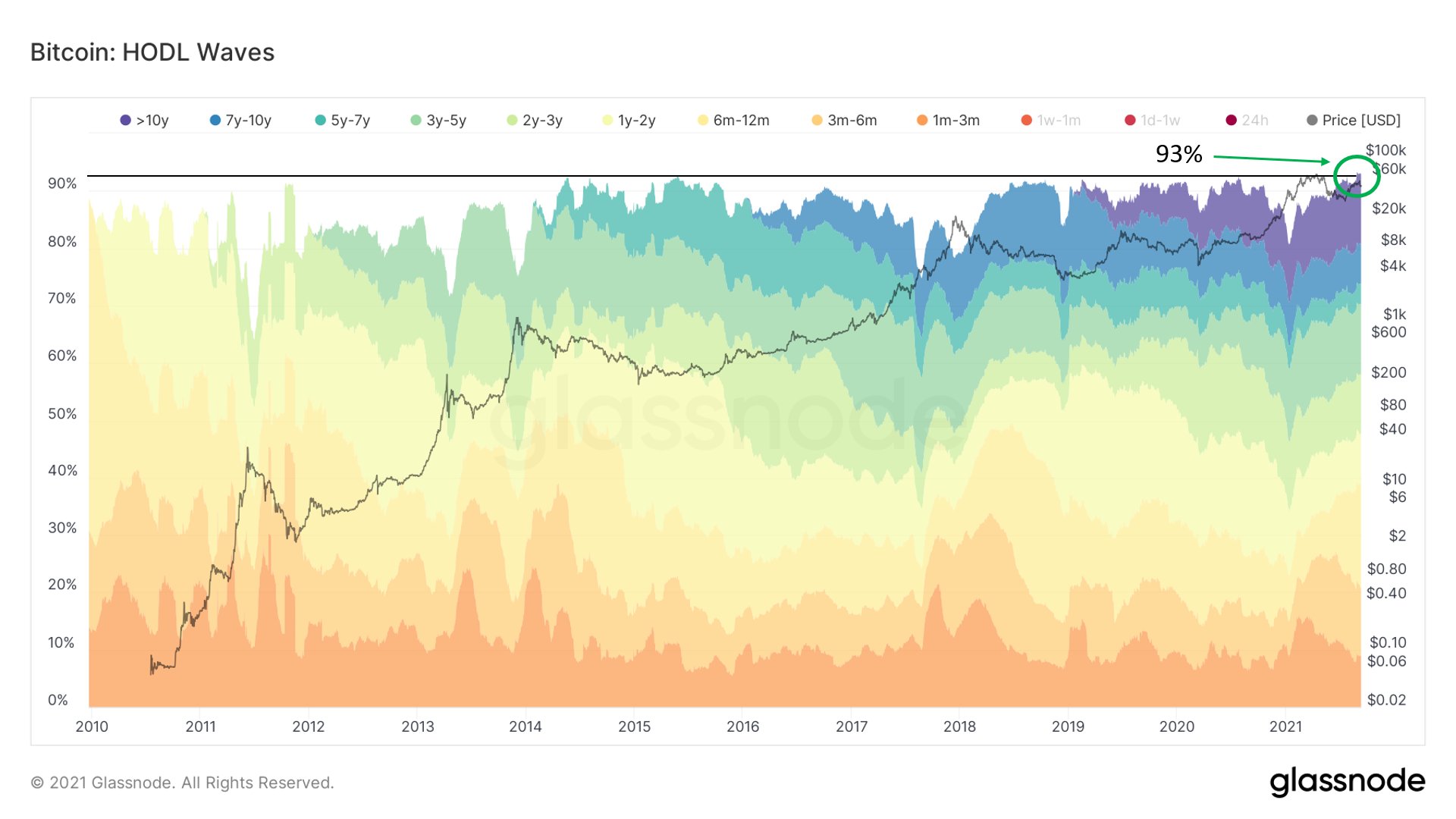

With spot traders hedging their bets on more downside, there has arguably never been a bigger disparity between on-chain metrics, adoption phenomena, and price.

“Stablecoin liquidity increasing, bitcoin on exchanges hit a 3-year low, normies awaken,” Moskovski Capital CEO Lex Moskovski summarized.

“If macro doesn’t sh*t on the bed, the next leg is programmed.”

Moskovski added later that macro markets had indeed started the week in green and that stablecoins were not used as shorting collateral made a clear bullish argument.

Cointelegraph reported that current price floor estimates are $43,000 to $38,000, with a rebound possible from such levels despite being far below important moving averages.

September has been a historically poor-performing month for Bitcoin, and as such, price predictions favor the “real” upside to recommence from October onwards.

“Remember more often than not bitcoin has a red month in September and a big price move in Q4,” popular Twitter account Lark Davis told followers Monday.