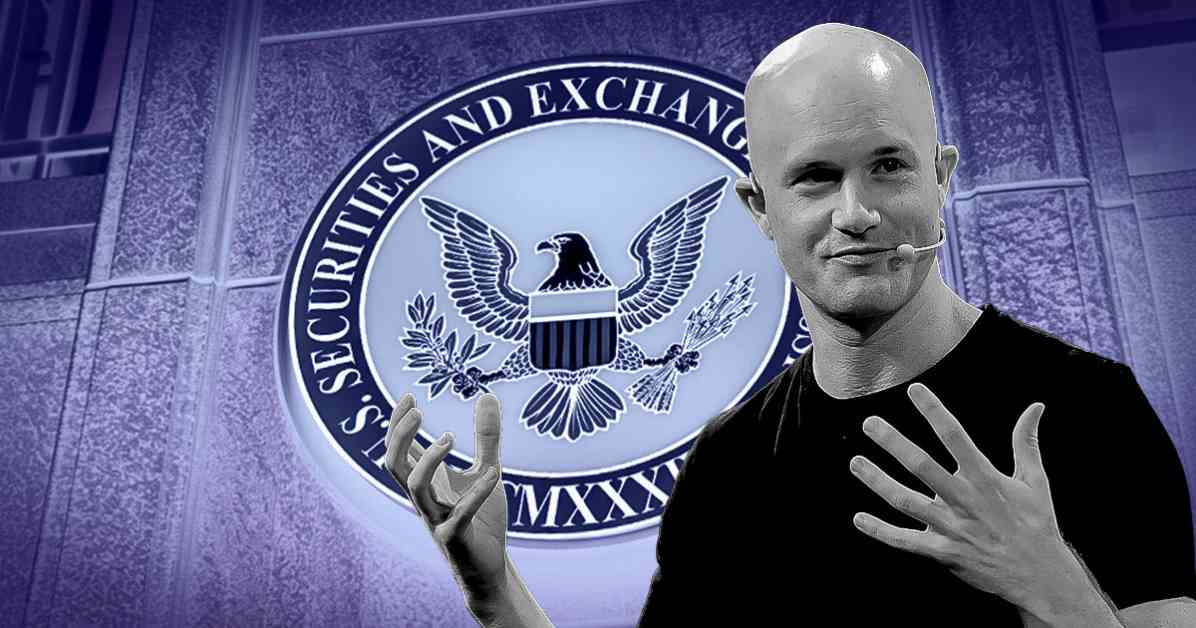

Coinbase CEO Brian Armstrong has recently spoken out against the SEC’s crackdown on crypto firms, urging the agency’s next leader to apologize for their actions. In a post on X, Armstrong pointed out the inconsistencies in the SEC’s approach to cryptocurrencies and highlighted the unnecessary lawsuits filed against companies like Coinbase. He believes that an apology from the SEC could be a first step in rebuilding trust with the American people, although it may not fully reverse the damage that has been done.

Under the leadership of Gary Gensler, the SEC has issued conflicting statements on whether digital assets should be considered securities and the extent of the agency’s regulatory authority over digital asset exchanges. This inconsistency has led to confusion within the industry and calls for more clarity and transparency in regulation.

Armstrong also raised concerns about the SEC’s shifting positions on Bitcoin’s classification, as well as its claims regarding regulatory oversight of crypto exchanges. The lack of consistency in the SEC’s approach to securities law has further fueled the need for regulatory clarity in the crypto space.

Many in the industry have called for Gensler’s removal as SEC Chair, with some even suggesting that potential future President Donald Trump would pursue this course of action if elected. The ongoing uncertainty and inconsistency in the SEC’s stance on cryptocurrencies have left many in the crypto community feeling frustrated and unsure about the future of regulation in the sector.

Armstrong’s call for accountability and transparency from the SEC’s leadership reflects a broader sentiment within the crypto industry, as companies and investors seek a clearer regulatory framework to operate within. The outcome of this debate will likely have far-reaching implications for the future of cryptocurrencies and digital assets in the United States.