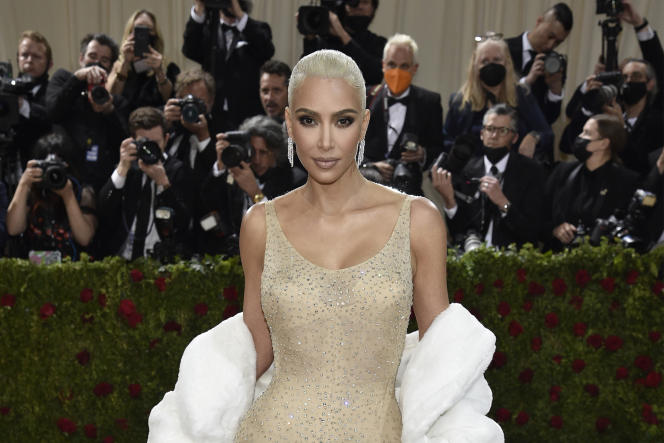

American star Kim Kardashian agreed to pay $1.26 million for praising a cryptocurrency on her Instagram account without mentioning that she was paid to do so, the Wall Street constable announced on Monday (October 3). , the SEC. The fine includes a penalty of $1 million as well as an adjustment of $260,000 which represents the amount received by Ms. Kardashian and interest.

The authority specifically accuses the reality TV star, influencer and businesswoman of having advertised a cryptocurrency asset, EMAX tokens, sold on EthereumMax, failing to indicate that she had been paid $250,000 per platform for this operation.

The ex-wife of rapper Kanye West, who agreed to cooperate with the SEC, also pledged not to promote cryptocurrency assets for three years. In the offending message she posted in June 2021, she wrote, all in capital letters: “Do you like crypto??? This is not financial advice but I am sharing with you what my friends just told me about the EthereumMax token! »

“Avoid protracted conflict”

“This case is a reminder that when celebrities or influencers promote investment opportunities, including cryptocurrency assets, that doesn’t mean those investment products are good for all investors,” Gary Gensler said in a statement. , the SEC boss, adding:

“We encourage investors to consider the potential risks and opportunities of an investment in light of their financial objectives. »

According to Forbes, Ms. Kardashian’s personal fortune is $1.8 billion. She has 331 million followers on Instagram. Already present in the world of make-up and sculpting underwear, she launched the private equity firm SKKY Partners in early September with Jay Simmons.

“Madame Kardashian is pleased to have resolved this matter with the SEC,” a star attorney responded in a statement, adding that his client had “fully cooperated with the SEC from the outset” and remained willing “to do whatever it can to assist the SEC in this matter.” And to clarify:

“She wants to put this matter behind her in order to avoid a protracted conflict. The agreement reached with the SEC allows him to do this and to move forward with his many entrepreneurial projects. »

Class action

Other celebrities have been caught in the past by US authorities for illegally promoting cryptocurrencies, including boxer Floyd Mayweather, rap star DJ Khaled, actor Steven Seagal and rapper T.I.

In January, investors also launched a class action lawsuit against Ms. Kardashian, Mr. Mayweather and former basketball player Paul Pierce, as well as the two founders of EthereumMax, accusing these personalities of having artificially inflated the price of the cryptocurrency. .

The virtual currency market, regularly criticized for being a universe of sometimes dubious practices for lack of clear and established regulations, has suffered a vertiginous fall for several months, investors being cautious in the face of volatile assets deemed to be at risk.

This “crypto winter” comes as U.S. regulators seek to step up pressure on several industry players. In early August, the Treasury Department imposed financial sanctions on “cryptocurrency mixer” Tornado Cash, accused of being used to launder more than $7 billion in virtual currency since 2019, including in connection with North Korea.