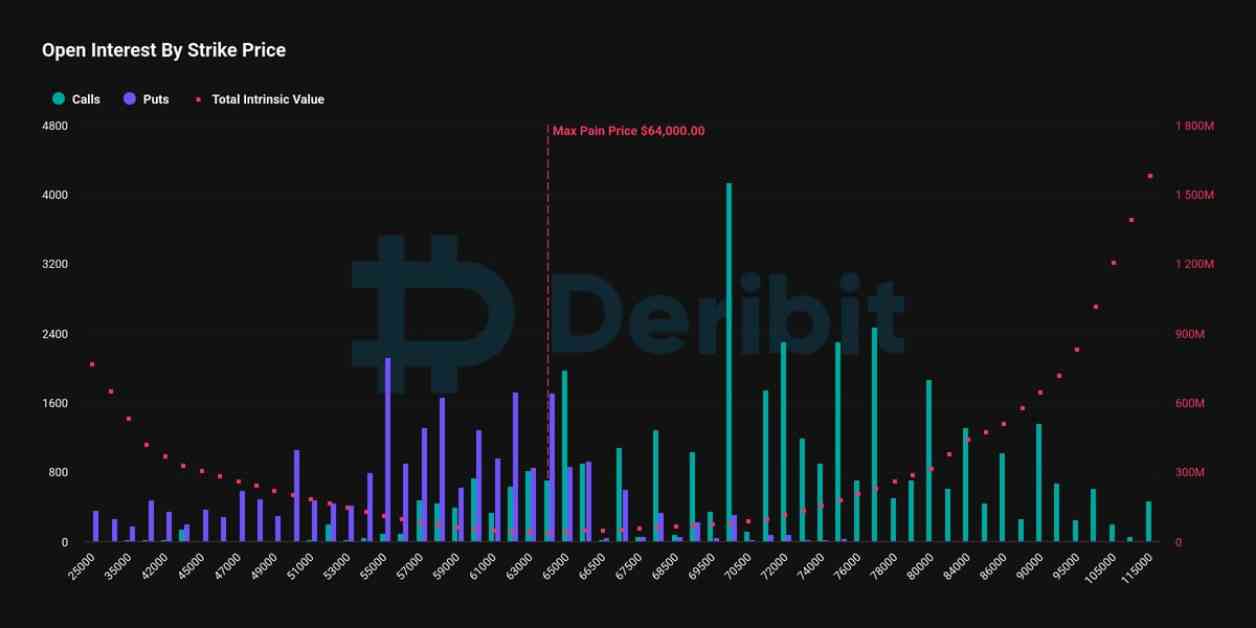

October’s options expiry is set to take place this Friday, with a significant impact on Bitcoin’s short-term volatility. A total of $4.2 billion in options for Bitcoin and over $1 billion for Ether are expected to expire. This expiration could lead to increased market volatility as traders with expiring contracts make decisions on whether to close their positions or roll them over into the next expiry.

One key point to note is that Bitcoin has a higher put/call ratio compared to Ether, indicating a more bullish sentiment among investors as the options expiry approaches. This sentiment is further supported by the fact that most of the in-the-money options set to expire are calls, with a strike price below the current market rate.

The options market for cryptocurrencies has seen significant growth over the past few years, with contracts worth billions of dollars expiring every month and quarter. Despite this growth, the options market remains relatively small compared to the spot market. For example, as of Friday’s data, the spot volume for Bitcoin was approximately $8.2 billion, while options volume was around $1.8 billion. Additionally, Bitcoin’s open interest of $4.2 billion due to expire this Friday is less than 1% of Bitcoin’s total market cap of $1.36 trillion.

Looking ahead, the options market is expected to continue growing, potentially expanding beyond Bitcoin and into other crypto-linked products as more institutional investors enter the market. The recent approval by the U.S. Securities and Exchange Commission (SEC) of options tied to spot Bitcoin ETFs is seen as a game-changer by industry experts. This approval, along with the possibility of trading options for other crypto products, could further boost the options market in the coming years.

Overall, the upcoming options expiry for Bitcoin and Ether is likely to create short-term volatility in the crypto market. Investors will be closely watching how the market reacts to the expiration of these contracts and whether it will have a significant impact on the spot prices of Bitcoin and Ether. As the market continues to evolve, the options market is expected to play an increasingly important role in shaping the overall cryptocurrency landscape.