Digital RMB testing for cross border payments and electrical vehicles proceeds, sentiment requires a dive and blockchain events return to meatspace.

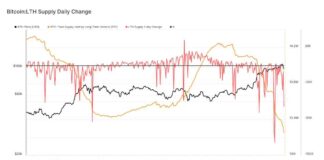

Sentiment in China has slumped as WeChat hunts for Bitcoin dropped 7% this week, while still searches for”bear market” increased 102%. One trend that remained powerful was NFT-related, together with NFTs getting an 86% rise in WeChat searches within the seven-day period. Token sales were another hot item with curiosity about Casper Labs surging later signups on CoinList breached 100,000 on global platforms.

1 high-profile token sale to emerge from China has been DAO-as-a-Service stage Dora Factory. The project, backed by DoraHacks, held a public token launching on March 21 with listings on OKEx, Gate and MXC. DoraHacks is famous for hosting programmer events and is among the most active blockchain developer communities to originate from China. The group will be hosting a global hackathon series in 2021, landing in regions including Singapore, the USA, Germany and India.

Real world events ago for spring time

Cointelegraph China kicked off their Hot Trends 2021 occasion in Chengdu on Thursday, welcoming a number of projects and business participants to the southern town. The event’s speeches and panels are exploring the sustainability of tendencies like DeFi and NFTs. Chengdu has been a significant city in the Chinese cryptocurrency mining space as a result of reduced electricity expenses and developed infrastructure.

Solana and Serum hosted a DeFi Night in Shanghai on March 20 because they continued promoting their ecosystem in Asia. The event also included speakers from Aave, Chainlink, Multicoin Capital, Raydium and The Graph. The ecosystem arms race is now significant as major players like BSC, Huobi (Heco), OKEx (OKExChain), and Solana all attempt to attract their share of their huge development pool in cities like Shanghai, Beijing, Shenzhen and Hangzhou. FTX creator Sam Bankman-Fried gave a keynote into the event via pre-recorded video.

Digital yuan evaluations

The Hong Kong Monetary Authority started working with the People’s Bank of China Digital Currency Research Institute to test the technology that enables the use of electronic yuan for cross-border obligations, according to Yu Wai-man. Yu is the present Chief Executive of the HKMA.

Also on March 19, many state-owned companies, under the guidance of the CPC Working Committee started applying the digital yuan to be utilized as a method of payment in charging electrical vehicles at the Xiongan new area near Beijing. One of these firms were also a sub-branch of the PBoC, Bank of China, China Telecom and the China State Grid. Joining the electronic yuan with fresh energy initiatives is rapidly becoming a priority for state-related organizations, especially with the announcement that the new five-year plan would target carbon neutrality by 2060.

On March 23, Chinese state media outlet Sina reported that the six largest major government-owned banks have started testing wallet services for the electronic yuan. The banks would be able to whitelist testers who can then download the mobile app and establish a sub-account. Stage 1 of the formal pilot should start next month

Ant Group’s blockchain paper

The paper outlined how government organizations can use information technology, electronic identity solutions and blockchain infrastructure to provide and handle data. Ant Group has experienced a challenging period after their highly-anticipated public that has been canceled amid worries regarding interest rates on digital lending.

Case research on money laundering

Ultimately, on March 21, the PBoC and the Supreme People’s Procuratorate (China’s greatest legal prosecuting authority) released six instances of modern money laundering methods, most of which comprised Bitcoin and cryptocurrency. In one of the instances, one convicted person received two decades in prison and a fine for illegal fundraising via an unlicensed digital currency trading system.