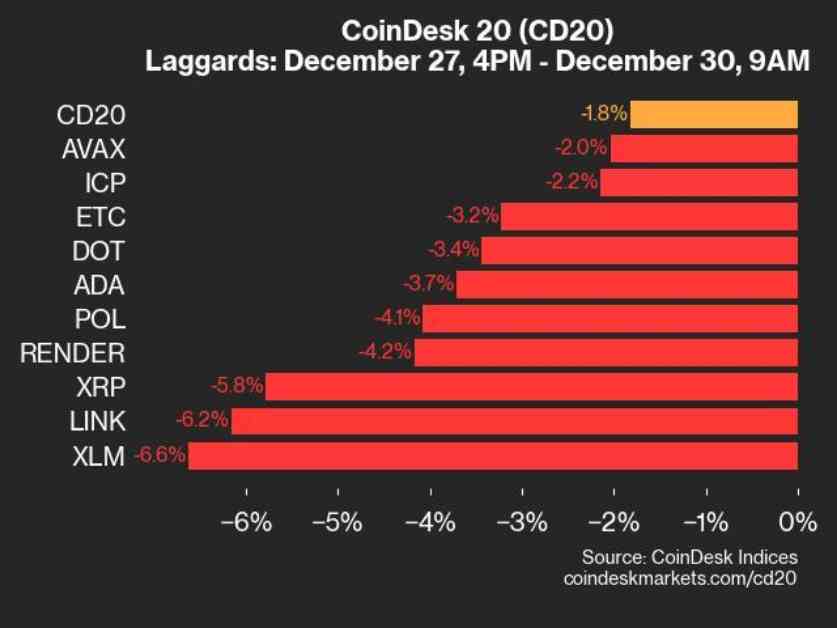

XLM Price Update: CoinDesk 20 Index Shows 6.6% Decline in Weekend Trading

Chainlink (LINK) joined Stellar (XLM) as an underperformer, falling 6.2% on December 30, 2024, at 2:32 p.m. UTC. The CoinDesk 20 Index, a widely-watched benchmark for the cryptocurrency market, is currently trading at 3254.32, reflecting a 1.8% decrease (-60.38) since Friday.

Leaders and Laggards:

Among the 20 assets in the index, three are trading higher. Solana (SOL) leads the pack with a 2.5% increase, followed by Alpha Finance Lab (APT) with a modest 0.8% uptick. On the flip side, Stellar (XLM) and Chainlink (LINK) lag behind with declines of 6.6% and 6.2%, respectively.

CoinDesk 20 Index Overview:

The CoinDesk 20 Index is a comprehensive gauge of the cryptocurrency market, traded across various platforms globally. It provides investors and enthusiasts with valuable insights into the performance of major digital assets, helping them make informed decisions in the ever-evolving crypto landscape.

Expert Insights from Tracy Stephens:

Tracy Stephens, Senior Index Manager at CoinDesk Indices, plays a crucial role in upholding the integrity and precision of trading data in the index. With a background in traditional finance and a deep understanding of quantitative research, Tracy brings a wealth of experience to the crypto space. Her academic achievements in Mathematics and Data Science further underscore her expertise in the field.

In a recent statement, Tracy emphasized the importance of monitoring market trends and staying vigilant in times of volatility. She highlighted the dynamic nature of the cryptocurrency market, where rapid fluctuations can present both risks and opportunities for investors.

As we navigate the complex world of digital assets, Tracy’s insights serve as a guiding light for market participants, offering valuable perspectives on navigating uncertainties and harnessing the potential of blockchain technology.

Remember, in the realm of cryptocurrency, staying informed and adaptable is key. Keep a close eye on market developments and expert analyses to make sound investment choices and stay ahead of the curve.