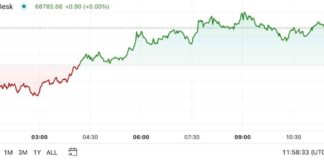

Bitcoin prices took a slight dip after a week of gains, dropping around 0.5% over a 24-hour period before bouncing back to stabilize just above $72,400.

There was a notable increase in inflows for U.S. bitcoin ETFs for the second consecutive day, with over $893 million invested on Wednesday following $879 million on Tuesday. This surge in ETF inflows suggests a strong institutional interest in bitcoin, especially as its market dominance continues to grow, according to some traders.

Bitcoin markets experienced some profit-taking in the past 24 hours following a strong week where the largest cryptocurrency saw a seven-day gain of nearly 8%. The price of BTC briefly fell to as low as $72,400 before climbing back up. Other major tokens like Solana’s SOL and Binance Chain’s BNB also saw losses, dropping by as much as 2.5%.

The CoinDesk 20 (CD20), which is a liquid index of the largest tokens by market capitalization, decreased by 1.3% in the last 24 hours. This pause in the market activity comes after a period of significant growth earlier in the week.

The consecutive days of substantial inflows into U.S. bitcoin ETFs are a clear indication of the increasing institutional demand for bitcoin. These ETFs received a total of $24 billion in cumulative net inflows since their introduction in January, with BlackRock’s IBIT attracting the majority of the inflows on Wednesday.

While most ETFs saw inflows, Bitwise’s BITB was the only product with net outflows, losing $23.9 million. The rise in BTC net inflows highlights the strong institutional interest in bitcoin as its dominance in the market continues to expand, traders noted.

Augustine Fan, head of insights at DeFi platform SOFA, pointed out that bitcoin has outperformed Ethereum by almost 10% on a week-on-week basis. The positive skew in equities, gold, and crypto prices suggests a bullish sentiment among investors, with more options being purchased betting on the price of assets to increase.

Overall, the growing institutional interest in bitcoin, as reflected in the significant ETF inflows, indicates a positive outlook for the cryptocurrency market despite the recent minor price correction. Investors are closely watching the market dynamics to capitalize on potential opportunities for further growth in the coming days.