Bitcoin’s price has taken a sharp dip recently, reminiscent of the Thanksgiving ‘Massacre’ that occurred in 2020. Back then, in just over 24 hours, Bitcoin plummeted by 17%. This year, on November 26, 2024, we are seeing a similar trend. However, there are some key differences to note.

In 2020, Bitcoin was on a bullish run, aiming to break the $20,000 mark, which it eventually did. But just as families were gathering for Thanksgiving, a wave of selling caused Bitcoin to drop from $19,500 to $16,200, marking a significant decline. This event was quickly labeled the Thanksgiving Day Massacre.

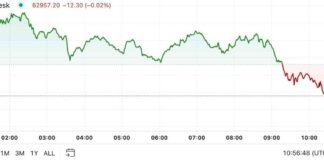

Fast forward four years to today, Bitcoin is experiencing another rapid decline after failing to surpass the $100,000 milestone. This time, the drop is not as severe as in 2020, with Bitcoin currently standing at $91,500, down by about 8%. Despite the similarities in the price drops, the scale and impact differ due to the higher starting point and the less drastic percentage decrease this time around.

Looking back at the aftermath of the 2020 drop, there is hope for a quick recovery. Just four days after the plunge, Bitcoin was back near $20,000 and eventually soared to a new record high of over $24,000 by mid-December. By the end of the year, Bitcoin was trading above $30,000, reaching a peak of $65,000 in April 2021 during the bull market.

It will be interesting to see how Bitcoin’s price trajectory unfolds in the coming days and whether history will repeat itself with a swift recovery. Observers and investors will be keeping a close eye on the market to gauge the potential for another bullish run or further decline.

Stephen Alpher, CoinDesk’s managing editor for Markets, provides valuable insights into Bitcoin’s price movements and market trends. With a background in finance and a deep understanding of cryptocurrency, Alpher’s analysis sheds light on the factors influencing Bitcoin’s price and the broader market dynamics. His expertise adds a layer of credibility and depth to the ongoing discussion around Bitcoin’s price fluctuations and the outlook for the digital asset.

As the cryptocurrency landscape continues to evolve, with Bitcoin at the forefront of the market, staying informed on the latest developments and expert opinions is crucial for investors and enthusiasts. The volatility of Bitcoin’s price underscores the importance of comprehensive analysis and a nuanced understanding of the factors driving market sentiment. By following expert commentary and monitoring market trends, stakeholders can make informed decisions and navigate the dynamic cryptocurrency market landscape effectively.