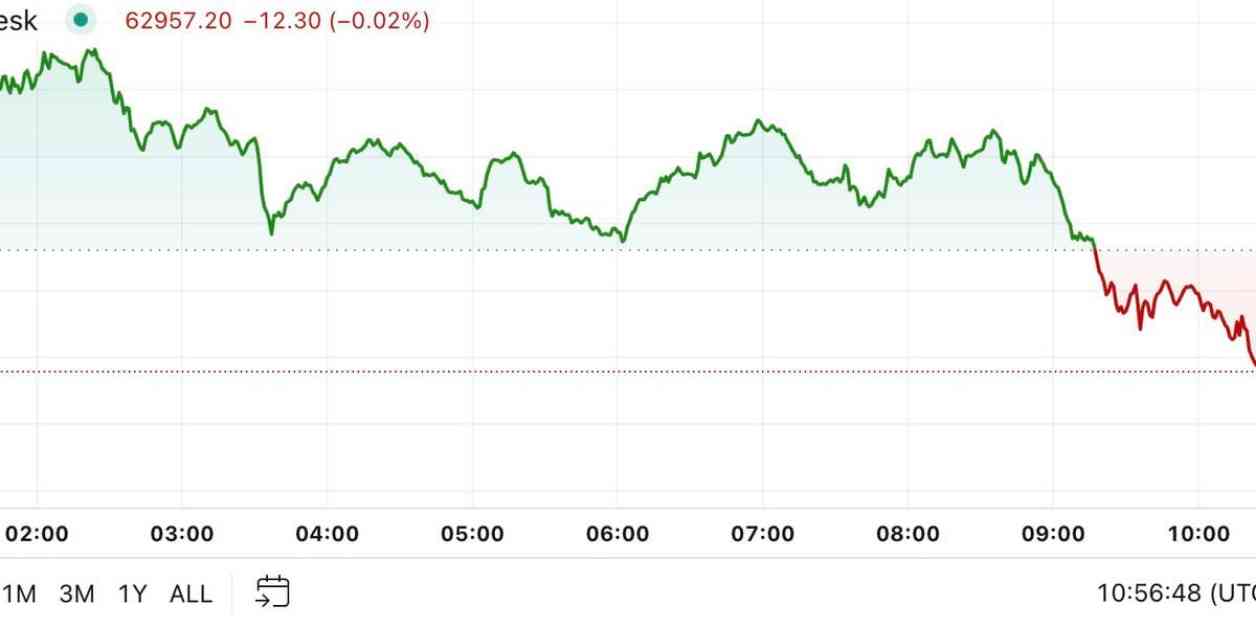

Bitcoin’s price surged to nearly $64,000 as investors awaited a busy week for economic data from the U.S. Despite a slight drop back to $63,000, the leading cryptocurrency was still up about 1.6% over the past 24 hours. The broader digital asset market also saw gains, with the CoinDesk 20 Index rising by approximately 1.5%.

The upcoming release of the Federal Open Market Committee (FOMC) minutes and key economic figures on Wednesday, along with data from the Bureau of Labor Statistics (BLS) on inflation and initial jobless claims, are expected to impact market sentiment.

Over the weekend, memecoins experienced a surge in popularity as social sentiment and risk-taking behavior among crypto traders increased. The concept of a “memecoin supercycle,” which suggests that meme tokens will drive the next bull market in crypto, gained traction on social platforms like X. Memecoins like Solana-based popcat (POPCAT), Ethereum-based mog (MOG), and BNB Chain-based simon’s cat (CAT) saw double-digit gains in a 24-hour period. Cat-themed memecoins continue to outperform their dog-themed counterparts, attracting investors seeking higher-risk meme bets.

Metaplanet, a Tokyo-listed company, recently announced an additional $6.7 million investment in bitcoin, increasing its total BTC holdings to 639.5, valued at approximately $40.6 million. With a focus on accumulating bitcoin at strategic price points, Metaplanet now ranks second among Asia-listed companies in terms of bitcoin holdings.

In the options market, the $40,000 bitcoin put expiring on Nov. 8, coinciding with the U.S. presidential election results, emerged as the most traded option on Deribit in the past 24 hours. Traders appear to be bracing for heightened volatility around the election outcome, with potential implications for crypto regulation.

As interest in memecoins grows amidst low volatility in traditional crypto sectors, such as layer-2 blockchains, and concerns over overvalued tokens linked to venture capital funding, the market continues to evolve. The rise of memecoins reflects a shift towards more speculative and social-driven investment trends within the crypto space.

Overall, the cryptocurrency market remains dynamic and responsive to a range of factors, from economic data releases to social media trends and institutional investment strategies. Investors should stay informed and adapt to changing market conditions to navigate the evolving landscape of digital assets effectively.