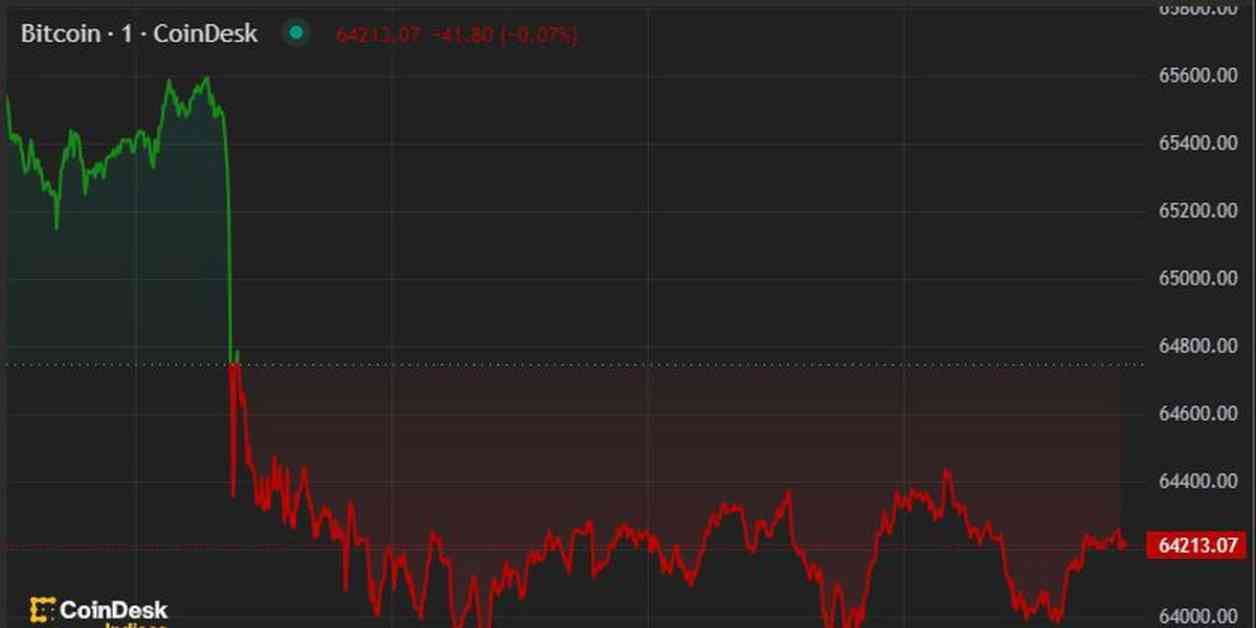

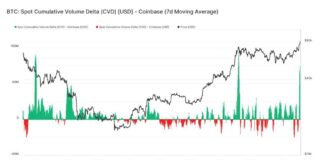

Bitcoin’s price has dropped to just above $64,000 in the Americas due to a stock market decline and weakening sentiment for risk assets. This led to over $250 million worth of bullish bets being liquidated, marking the worst hit since early July. At the time of writing, Bitcoin is priced around $64,200, showing a drop of almost 3.5% in the last 24 hours. The broader digital asset market, as measured by the CoinDesk 20 Index (CD20), has fallen by 5.6%. This decline follows the tech-heavy Nasdaq 100 index posting its biggest drop since 2022 after Google parent company Alphabet and Tesla reported mixed quarterly earnings.

Ether (ETH) has seen a decrease of over 8% in the last 24 hours, performing worse than the wider crypto market. This drop follows $327 million worth of outflows from Grayscale’s Ethereum Trust ETF (ETHE). Despite this, most of the other ETH ETFs continued to perform well during the Wednesday session. BlackRock’s ETHA led the pack with $283.9 million of net inflows, followed by Bitwise’s ETHW at $233.6 million and Fidelity’s FETH with $145.7 million. The situation with ETHE mirrors the struggles of Grayscale’s bitcoin equivalent, GBTC, which also experienced heavy outflows earlier this year. Ether is currently trading at $3,165.

Furthermore, the aggregate market capitalization of the stablecoin sector, which consists of hundreds of coins, has surpassed $164 billion for the first time since the collapse of Terra in May 2022. This information comes from data source DefiLlama and trading firm Wintermute. The increase in stablecoin supply indicates growing investor optimism, which supports a bullish outlook for the market. According to Wintermute, the rise in stablecoin supply reflects money being deposited into on-chain ecosystems to drive economic activity, either through direct on-chain purchases or yield-generation strategies. This activity ultimately promotes positive on-chain growth.

In other news, activity in Chicago Mercantile Exchange’s ether futures hit new highs on Tuesday following the introduction of spot ETH ETFs in the U.S. The surge in trading volume was significant, with 14,736 contracts changing hands, three times higher than the average daily volume seen throughout July. Giovanni Vicioso, global head of cryptocurrency products at CME Group, attributed the spike in activity to the launch of spot ether ETF trading in the U.S.

It’s important to note that CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. The publication operates independently, with an editorial committee ensuring journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation. This update follows CoinDesk being acquired by the Bullish group, which is majority-owned by Block.one, in November 2023. Both companies have interests in various blockchain and digital asset businesses, as well as significant holdings of digital assets, including bitcoin.